FMCG industry

◆ The Russian-Ukrainian conflict is expected to accelerate price increases across the supply chain, disrupt trade flows, further cut disposable incomes, and be detrimental to the recovery of the pandemic. Several FMCG companies have stopped local operations in Ukraine, and Western consumers have begun boycotting Russian brands, though the impact is not yet clear.

Food service industry:

◆ Ukraine and Russia together account for about one-third of the world's wheat exports and are the two largest exporters of sunflower oil. Supply disruptions will lead to higher global wheat prices, and food service companies in the bakery industry and food preparation stage will face a series of questions.

◆ Rising energy costs will also add to inflationary pressures, so we're not sure how long catering companies will be able to absorb the extra costs or keep menu prices stable for consumers.

Banking and Payments Industry:

◆ Unlike other industries, banking and payments are used as a tool to prevent Russia's military strikes against Ukraine, mainly by prohibiting Russia's use of major payment systems such as SWIFT, to prevent Russia from participating in international trade. Cryptocurrencies are not under the control of the Russian government, and the Kremlin is unlikely to use it this way.

Medical insurance:

◆ The Russian healthcare sector may soon feel the indirect effects of the conflict. With sanctions intensifying and deteriorating economic conditions, hospitals will soon face daily shortages of imported medical materials.

Insurance:

◆ Political risk insurers face an increase in claims for losses related to political unrest and conflict. Some insurers have stopped underwriting political risk policies covering Ukraine and Russia.

◆ Sanctions will cause some insurers to automatically stop air or marine insurance. Insurers and reinsurers in the European Union are barred from servicing goods and technologies designed to enhance Russia's aviation and space industries.

◆ The high risk of cyber-attacks poses significant challenges for cyber insurers. Cyberattacks can cross national borders and can result in significant losses. Cyber insurers are unlikely to uphold war coverage exclusions.

◆ Premiums are bound to increase due to increased risk of loss due to political instability, including political risk, marine, air, transport cargo and cyber insurance.

Medical instruments:

◆ Due to deteriorating economic conditions, financial sanctions and technology embargoes, Russia's medical device industry will be negatively affected by the Russian-Ukrainian conflict, as most medical devices are imported from the United States and Europe.

◆ As the conflict continues, civil aviation in Europe and Russia will be severely disrupted, affecting the distribution of airborne medical equipment. The medical supply chain is expected to continue to be disrupted as some materials, such as titanium, come from Russia.

◆ The loss of Russian exports of medical devices is not expected to be significant, as these represent less than 0.04% of the value of all medical devices sold globally.

Send your message to us:

-

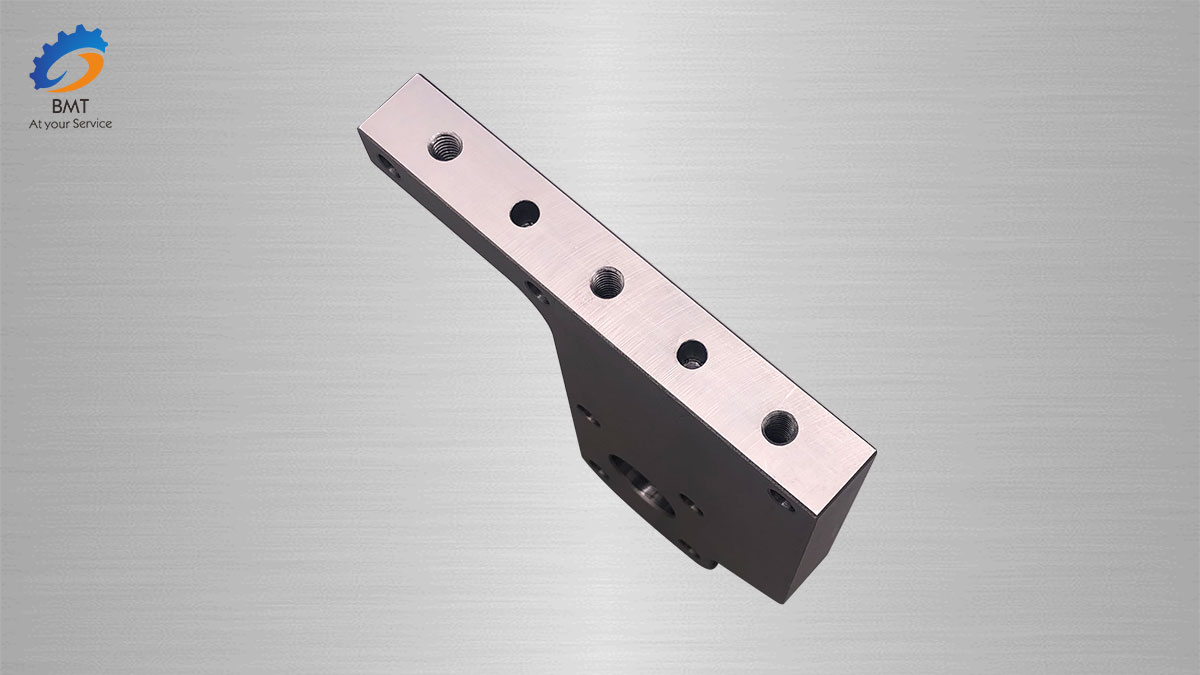

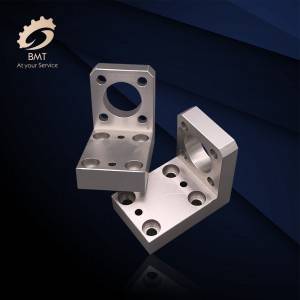

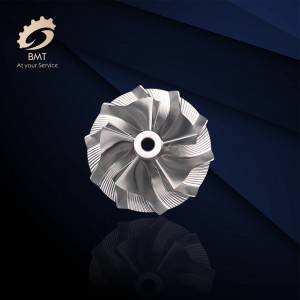

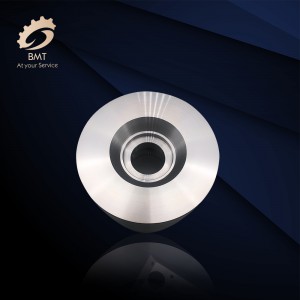

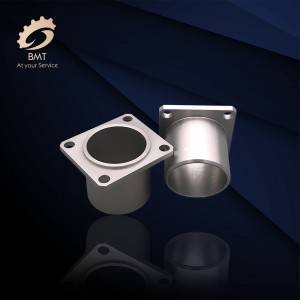

Aluminum CNC Machining Parts

-

Aluminum Sheet Metal Fabrication

-

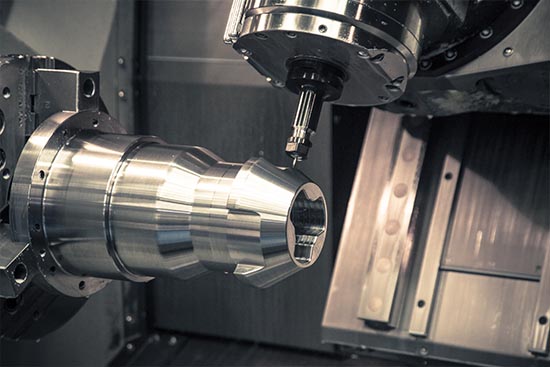

Axis High Precision CNC Machining Parts

-

CNC Machined Parts for Italy

-

CNC Machining Aluminum Parts

-

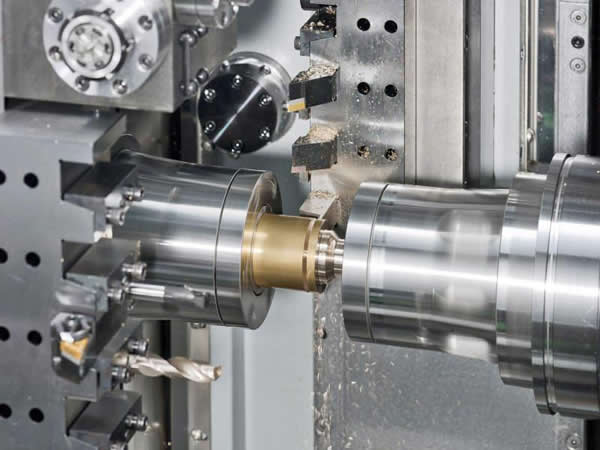

Auto Parts Machining

-

Titanium Alloy Forgings

-

Titanium and Titanium Alloy Fittings

-

Titanium and Titanium Alloy Forgings

-

Titanium and Titanium Alloy Wires

-

Titanium Bars

-

Titanium Seamless Pipes/Tubes

-

Titanium Welded Pipes/Tubes