Automotive Industry

◆ As a regional auto market, Russia's global position is relatively unimportant. Therefore, those working in the automotive industry can ride out this crisis. But with more auto industry players suspending local operations in Russia and the fallout from the conflict, a collapse of the market and car production is now inevitable in Russia, especially Ukraine.

◆ The current global supply of light vehicles is seriously insufficient, mainly due to the still severe shortage of chips. This means that even farther away from crisis-hit Ukraine and Russia, further intensification of inflation will have cascading macroeconomic effects, leading to a decline in underlying demand in the auto industry and short-term risks to global light vehicle sales and production.

Banking and Payments Industry:

◆ Unlike other industries, banking and payments are used as a tool to prevent Russia's military strikes against Ukraine, mainly by prohibiting Russia's use of major payment systems such as SWIFT, to prevent Russia from participating in international trade. Cryptocurrencies are not under the control of the Russian government, and the Kremlin is unlikely to use it this way.

◆ With the rapid decline in the purchasing power of customer deposits, consumer confidence in the Russian financial system has been damaged, and consumer demand for cash, especially foreign currency, has increased. In addition, the European subsidiaries of Russian banks were also forced into bankruptcy due to sanctions. So far, Russia's two largest banks, VTB and Sberbank, have not been included in the sanctions. Western-based Digital challenger banks and Fintechs have been facilitating customers who support Ukraine with charitable donations.

◆ Ukraine's construction industry has been expanding rapidly, but today's outlook is bleak, with major projects currently underway likely to be put on hold, new investment plans being put on hold, and government attention and resources being diverted to military operations. European markets, which border Russia, could also suffer if investor confidence in more regions takes a hit.

◆ Russia's military intervention exacerbated upward pressure on oil and energy prices, resulting in higher production and transportation costs for key construction materials, which will also have an indirect impact on the construction industry in the wider region. Russia and Ukraine are also major producers and exporters of steel (mainly to the EU market).

Send your message to us:

-

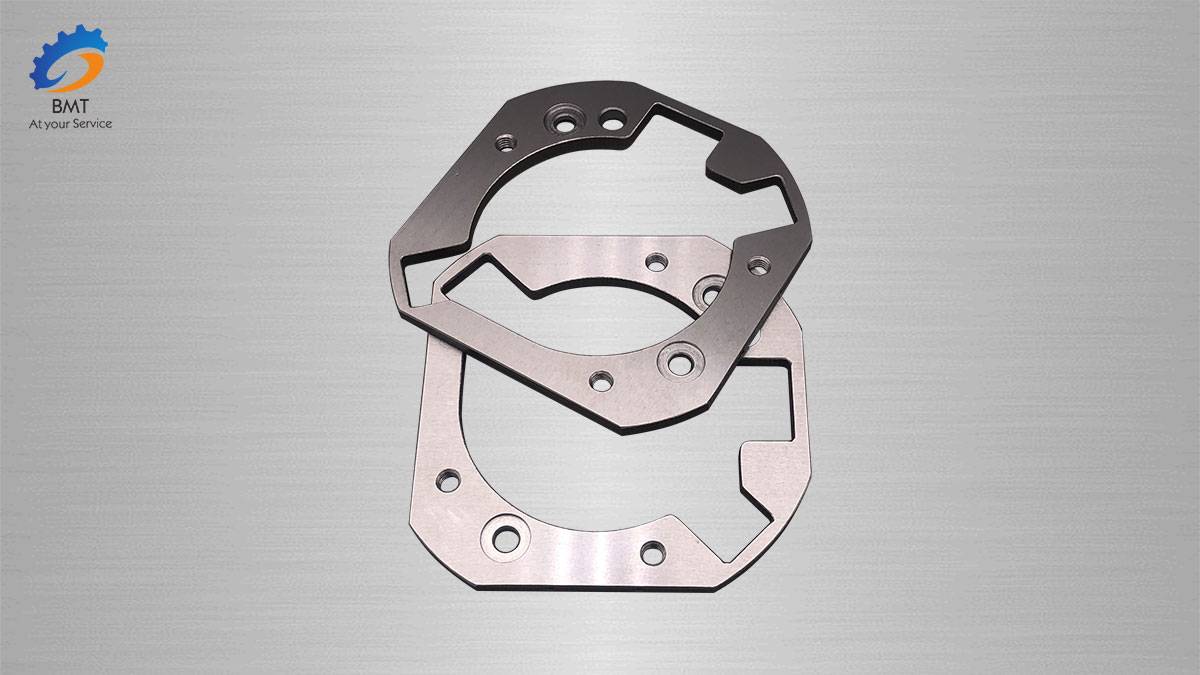

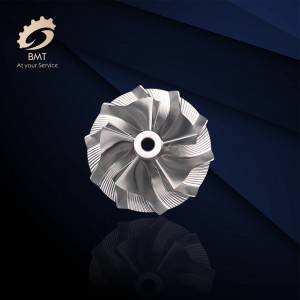

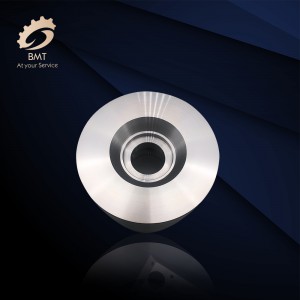

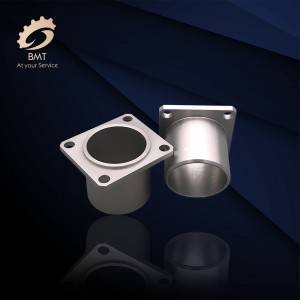

Aluminum CNC Machining Parts

-

Aluminum Sheet Metal Fabrication

-

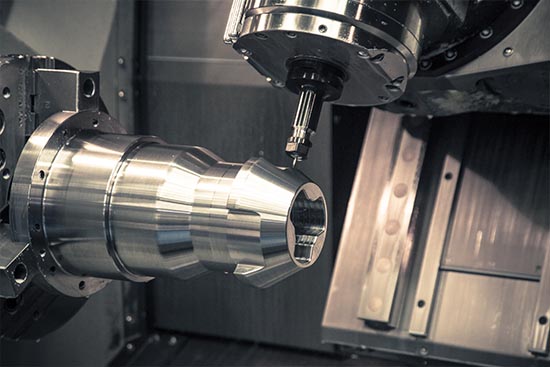

Axis High Precision CNC Machining Parts

-

CNC Machined Parts for Italy

-

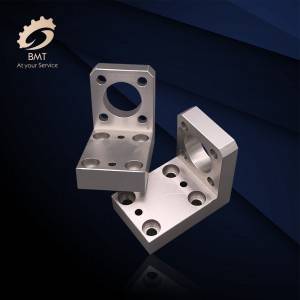

CNC Machining Aluminum Parts

-

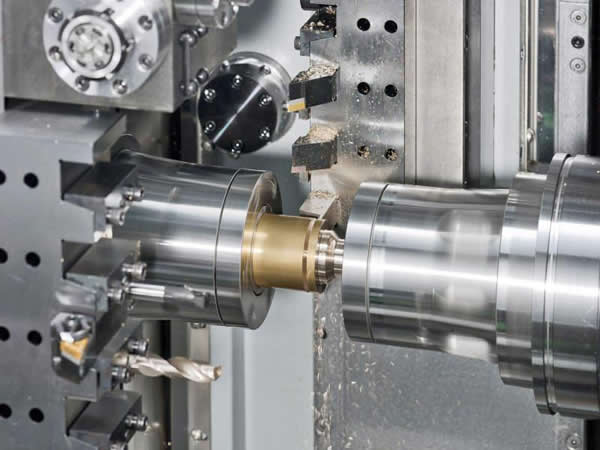

Auto Parts Machining

-

Titanium Alloy Forgings

-

Titanium and Titanium Alloy Fittings

-

Titanium and Titanium Alloy Forgings

-

Titanium and Titanium Alloy Wires

-

Titanium Bars

-

Titanium Seamless Pipes/Tubes

-

Titanium Welded Pipes/Tubes