In the medium and long term, the negative impact of Western economic sanctions on the global economy may far exceed the Russian-Ukrainian conflict itself. It not only disrupts global production and supply chains and disrupts the normal operation of the market, but also undermines multilateral trade rules and encourages unilateralism. The outlook for global economic growth will become dim and more uncertain.

The global energy prices

Russia is the world's second largest oil exporter, is Europe's largest gas supplier, conflict between Russia and Ukraine continue to push up global energy prices. Conflict began on February 24, 2022, 25 WT crude oil prices soared from $91.59 a barrel, on March 8, from highs of $123.7 a barrel. After March 16 day dropped to $95.04 a barrel, on March 22, price is $111.76 a barrel. Natural gas prices are also rising, other European countries in "expired" crisis.

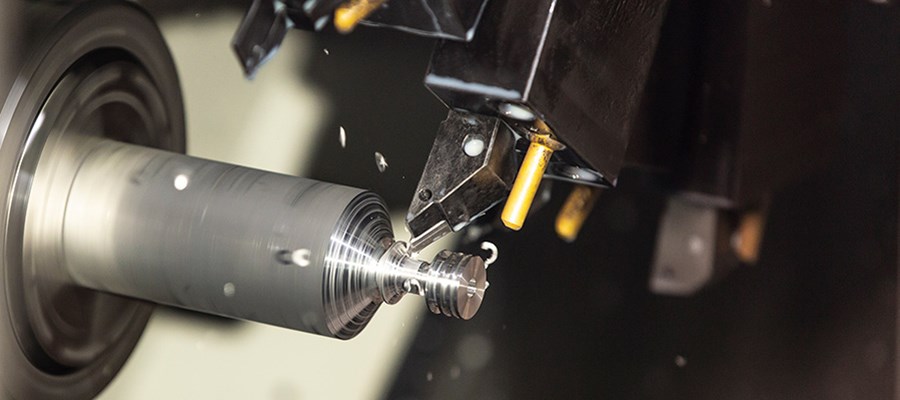

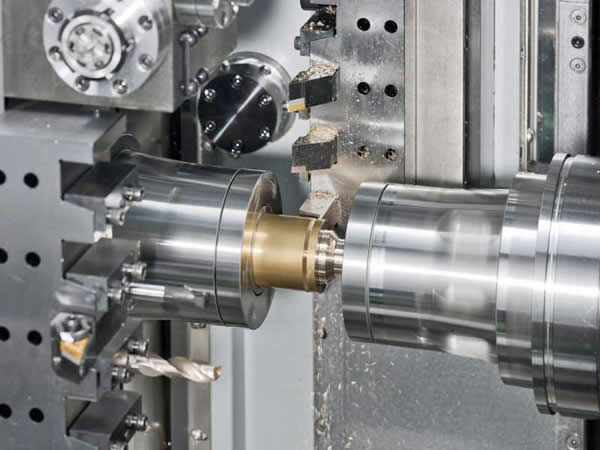

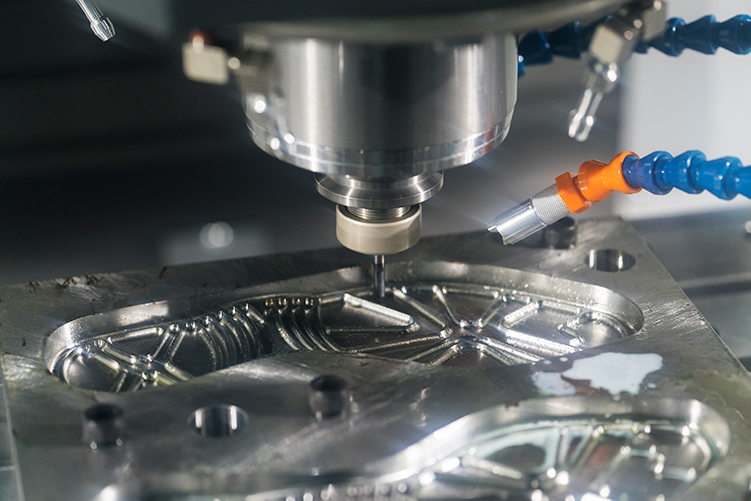

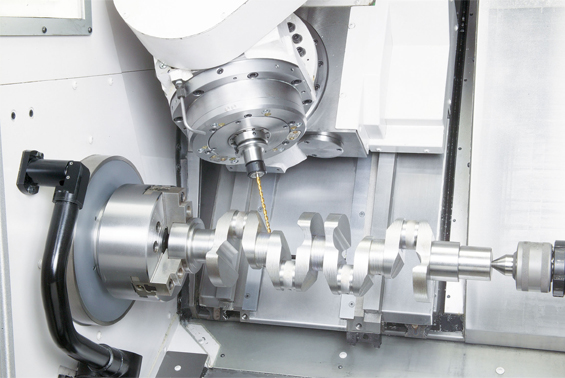

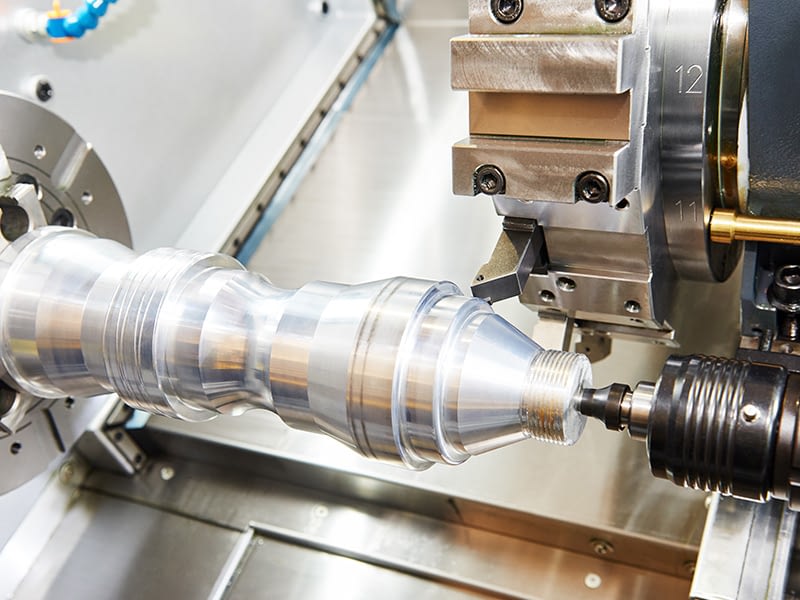

Global rare metals and raw material prices

Russia is nickel, copper, iron, and the atmosphere, aluminum, titanium and palladium and platinum key strategic mineral resources such as the main producer and exporter, controls about 10% of the world's copper reserves.Another Ukraine and Russia, is also an important production and hydrogen gas exporter.

After the conflict between Russia and Ukraine, market volatility. As of March 28, 2022, the London metal exchange (LME) nickel, aluminum, copper prices rose 75.3%, 28.3% and 4.9% respectively than the end of 2021, and affect the production cost of multiple industries around the world.

The impact on the global financial markets

Ukraine war's influence on the world economy, but also lies in the financial market turmoil. After the war between Russia and Ukraine, UK, Germany, Britain, China and shenzhen, the nasdaq and the dow Jones stock index has fallen sharply. Is the stock market value in China listed in the U.S. evaporate once more than $10000;

Other western Russian oil embargo and freeze in the Russian central bank reserves, also directly caused the Russian stock market crash, the rouble devaluation, capital flight, government debt face a series of problems, such as the risk of default forced the central bank unprecedented will raise interest rates from 9.5% to 20%.

Post time: Aug-26-2022