Russia-Ukrine Conflict Effect for Machining

As the world grapples with Covid-19, the Russian-Ukrainian conflict threatens to exacerbate existing global economic and supply challenges. The two-year pandemic has left the world financial system vulnerable, with many economies facing heavy debt burdens and the challenge of trying to normalize interest rates without derailing the recovery.

Increasingly tough sanctions on Russian banks, major companies and important people, including restrictions on certain Russian banks from using the SWIFT payment system, have led to the collapse of the Russian stock exchange and the ruble exchange rate. Aside from Ukraine's hit, Russian GDP growth will likely be hit hardest by the current sanctions.

The magnitude of the impact of the Russian-Ukrainian conflict on the global economy will largely depend on the risks to Russia and Ukraine in terms of overall trade and energy supplies. Existing tensions in the global economy will intensify. Energy and commodity prices are under more pressure (corn and wheat are more of a concern) and inflation is likely to remain elevated for longer. To balance inflationary pressures with economic growth risks, central banks are likely to respond more dovishly, meaning plans to tighten the current ultra-easy monetary policy will ease.

Consumer-facing industries are likely to feel the biggest chill, with disposable income under pressure from rising energy and gasoline prices. Food prices will be in focus, with Ukraine the world's leading exporter of sunflower oil and the fifth-largest exporter of wheat, with Russia the largest. Wheat prices are under pressure due to poor harvests.

Geopolitics will gradually become a normal part of the discussion. Even without a new Cold War, tensions between the West and Russia are unlikely to ease anytime soon, and Germany has pledged to focus on investing in its armed forces. Not since the Cuban missile crisis has global geopolitics been so volatile.

Send your message to us:

-

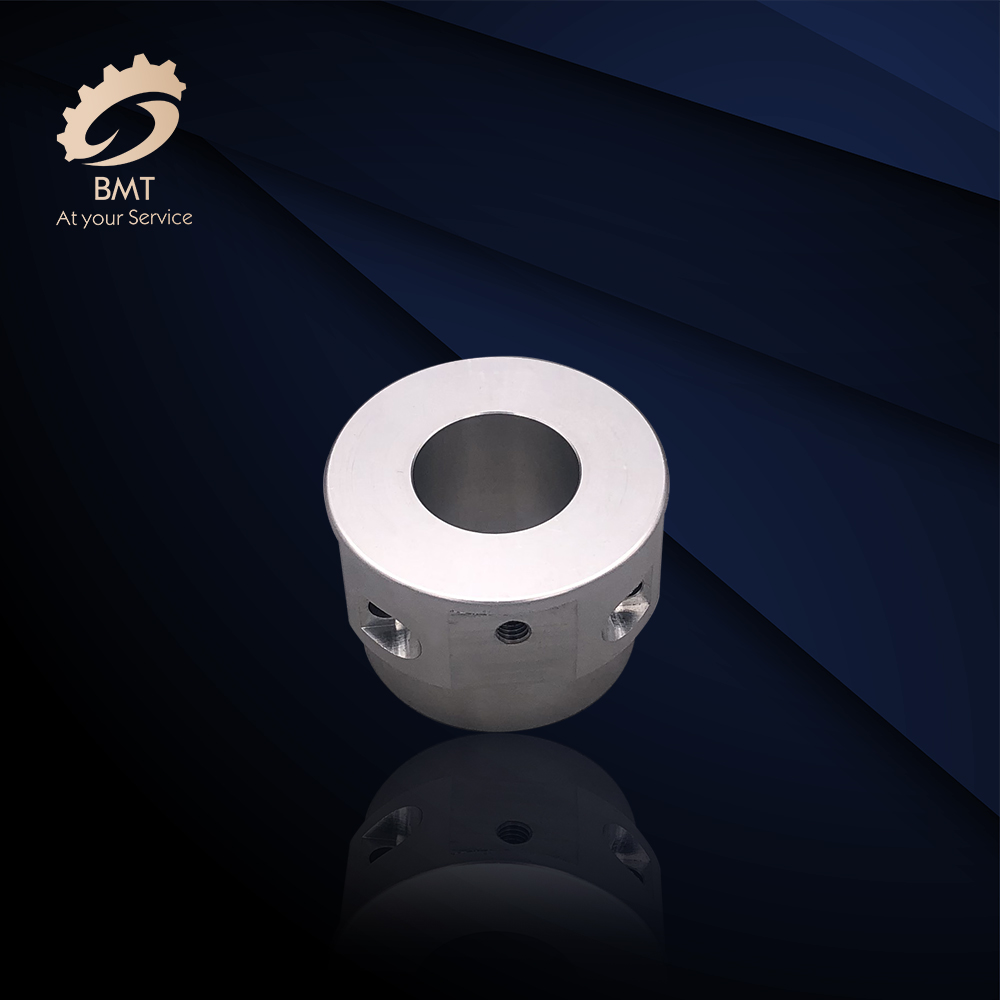

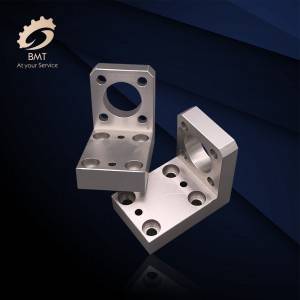

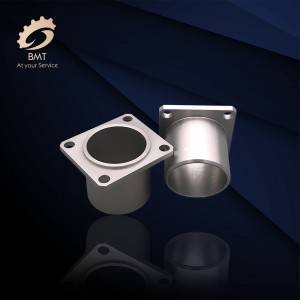

Aluminum CNC Machining Parts

-

Aluminum Sheet Metal Fabrication

-

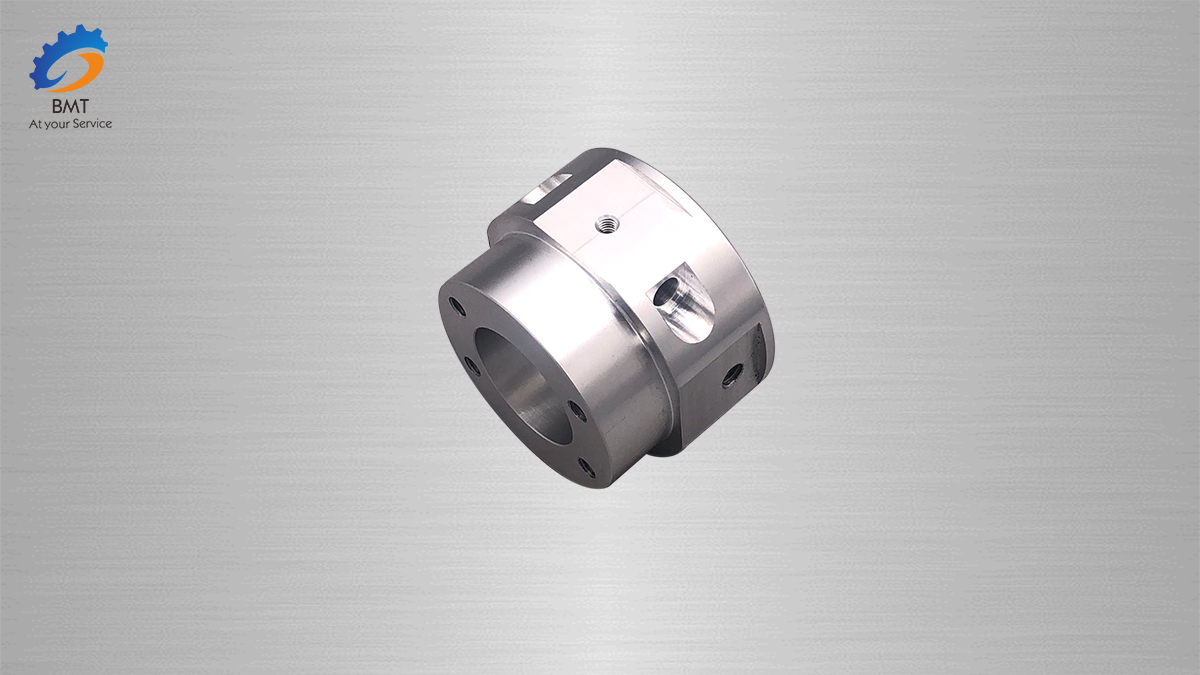

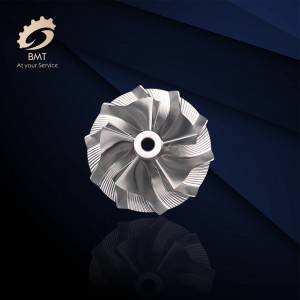

Axis High Precision CNC Machining Parts

-

CNC Machined Parts for Italy

-

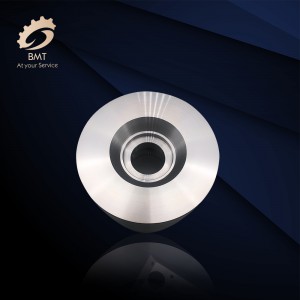

CNC Machining Aluminum Parts

-

Auto Parts Machining

-

Titanium Alloy Forgings

-

Titanium and Titanium Alloy Fittings

-

Titanium and Titanium Alloy Forgings

-

Titanium and Titanium Alloy Wires

-

Titanium Bars

-

Titanium Seamless Pipes/Tubes

-

Titanium Welded Pipes/Tubes